Introduction

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. When it comes to choosing the right life insurance policy, two main options stand out: term life insurance and whole life insurance. Understanding the differences between these two types of coverage is essential in making an informed decision that aligns with your needs and financial goals.

In this comprehensive guide, we will explore the key characteristics, benefits, and drawbacks of both term life insurance and whole life insurance. We will delve into the cost considerations, coverage duration, cash value accumulation, and other important factors that can influence your choice. By the end of this article, you will have a clear understanding of which type of life insurance is the best fit for you and your family.

Term Life Insurance: An Overview

Term life insurance is a type of life insurance that provides coverage for a specified period, known as the “term.” This period can range from 10 to 30 years, depending on the policy. If the insured individual passes away during the term, the policy pays out a death benefit to the beneficiaries. However, if the insured individual survives the term, there is no payout at the end of the policy.

How Term Life Insurance Works

Term life insurance is relatively straightforward. You pay regular premiums to the insurance company, and in return, they provide coverage for the predetermined term. The policy’s death benefit is paid out to your beneficiaries if you pass away within the term. The death benefit can be used to cover various expenses, such as funeral costs, mortgage payments, or college tuition.

There are two main types of term life insurance: level term and decreasing term. In a level term policy, the death benefit and premiums remain the same throughout the term. This type of policy is the most common and provides consistent coverage. On the other hand, a decreasing term policy has a death benefit that decreases over time while the premiums remain constant. Decreasing term policies are often used to cover specific liabilities that decrease over time, such as a mortgage.

Types of Term Life Insurance

Term life insurance policies come in various forms to cater to different needs and preferences. Some common types of term life insurance include:

- Annual Renewable Term (ART) Insurance: This type of policy is renewed on a yearly basis, with premiums increasing each year as the insured individual gets older.

- Level Term Insurance: As mentioned earlier, level term insurance provides coverage for a specific duration with fixed premiums and a consistent death benefit.

- Convertible Term Insurance: Convertible term insurance allows policyholders to convert their term policies into permanent life insurance policies, such as whole life or universal life insurance, without undergoing a medical exam.

- Group Term Insurance: Group term insurance is often offered through employers or professional associations. It provides coverage for a group of individuals and may be more affordable than individual policies.

Pros and Cons of Term Life Insurance

Like any financial product, term life insurance has its advantages and disadvantages. Understanding these can help you determine if term life insurance is the right choice for you.

Pros:

- Affordability: Term life insurance is generally more affordable than whole life insurance, making it an attractive option for individuals on a budget.

- Flexibility: With term life insurance, you have the flexibility to choose the coverage duration that aligns with your specific needs. This is particularly beneficial if you have short-term financial obligations.

- Simplicity: Term life insurance is relatively straightforward and easy to understand, making it accessible to individuals who may not be familiar with complex insurance products.

Cons:

- No Cash Value: Unlike whole life insurance, term life insurance does not accumulate cash value over time. This means that if you outlive the policy, you do not receive any return on your premiums.

- Limited Coverage Duration: Term life insurance only provides coverage for a specified term. If you require lifelong coverage, term life insurance may not be suitable.

- Premium Increases: Premiums for term life insurance policies typically increase with age, especially if you choose a renewable term policy. This can make the coverage less affordable in the long run.

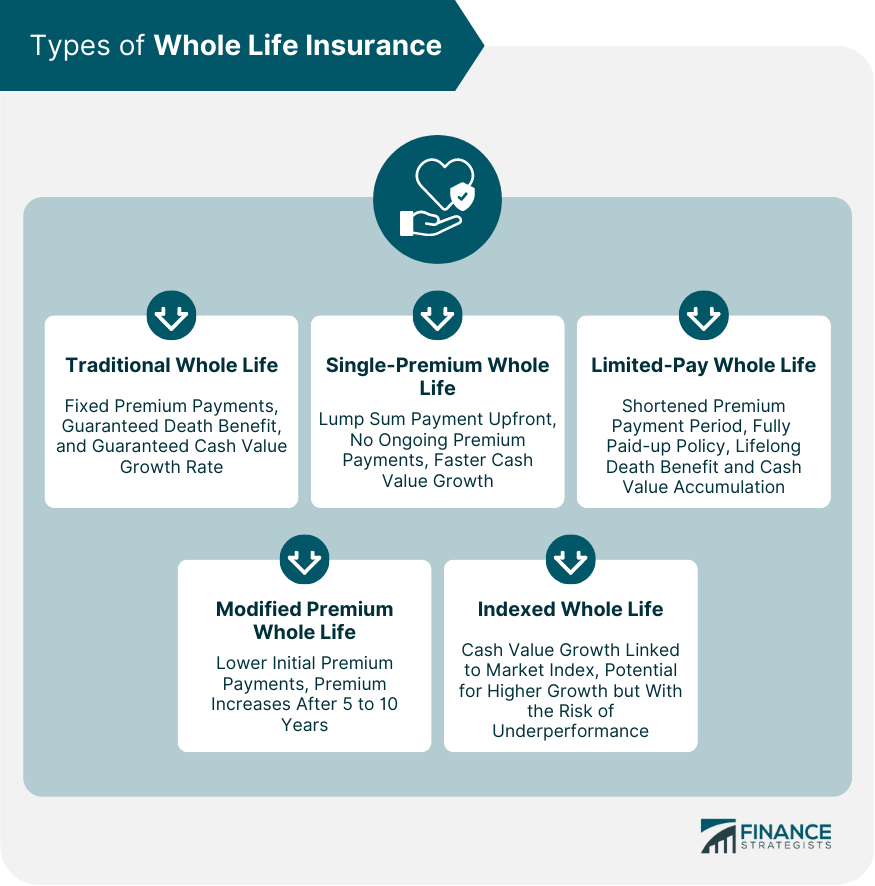

Whole Life Insurance: An Overview

Whole life insurance, also known as permanent life insurance, offers coverage for the entire duration of the insured individual’s life. Unlike term life insurance, which provides coverage for a specific term, whole life insurance does not expire as long as the premiums are paid. One of the key features of whole life insurance is the accumulation of cash value over time.

How Whole Life Insurance Works

Whole life insurance provides lifelong coverage, meaning that the policy remains in force until the insured individual passes away. Premiums for whole life insurance are typically higher than those for term life insurance because they cover a longer period and include the cash value component.

A portion of the premium paid towards a whole life insurance policy goes into an account called the “cash value.” The cash value grows over time, similar to a savings account, and earns interest at a fixed rate set by the insurer. The policyholder can access the cash value through policy loans or withdrawals.

Cash Value Accumulation

One of the primary advantages of whole life insurance is the accumulation of cash value. The cash value grows over time and can be utilized in several ways:

- Policy Loans: Policyholders can borrow against the cash value of their whole life insurance policy. The loan is typically subject to interest charges, and any outstanding loan balance reduces the death benefit payable to beneficiaries.

- Withdrawals: Policyholders can also make partial withdrawals from the cash value of their whole life insurance policy. These withdrawals are tax-free up to the amount of the premiums paid into the policy. Any excess withdrawals may be subject to taxes.

- Policy Surrender: If you decide to surrender your whole life insurance policy, you can receive the cash value accumulated up to that point. However, surrendering the policy means giving up the death benefit protection.

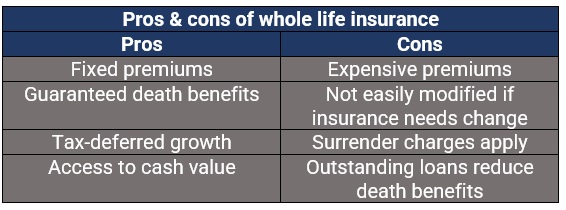

Pros and Cons of Whole Life Insurance

Whole life insurance offers unique features and benefits that may make it the right choice for certain individuals. However, it is important to consider the drawbacks as well.

Pros:

- Lifelong Coverage: Whole life insurance provides coverage for the entire duration of the insured individual’s life, ensuring that your loved ones receive a death benefit regardless of when you pass away.

- Cash Value Accumulation: The cash value component of whole life insurance allows you to accumulate savings over time, which can be accessed through policy loans or withdrawals.

- Stable Premiums: Premiums for whole life insurance remain fixed throughout the policy’s duration, providing predictability and stability.

Cons:

- Higher Premiums: Whole life insurance typically has higher premiums compared to term life insurance. The additional cost is attributed to the lifelong coverage and the cash value accumulation feature.

- Complexity: Whole life insurance policies can be more complex than term life insurance policies. Understanding the various components, such as the cash value, policy loans, and dividends, may require additional effort and financial knowledge.

- Limited Flexibility: Whole life insurance policies are less flexible compared to term life insurance policies. If your financial needs change, it may be challenging to adjust the coverage or premium payments.

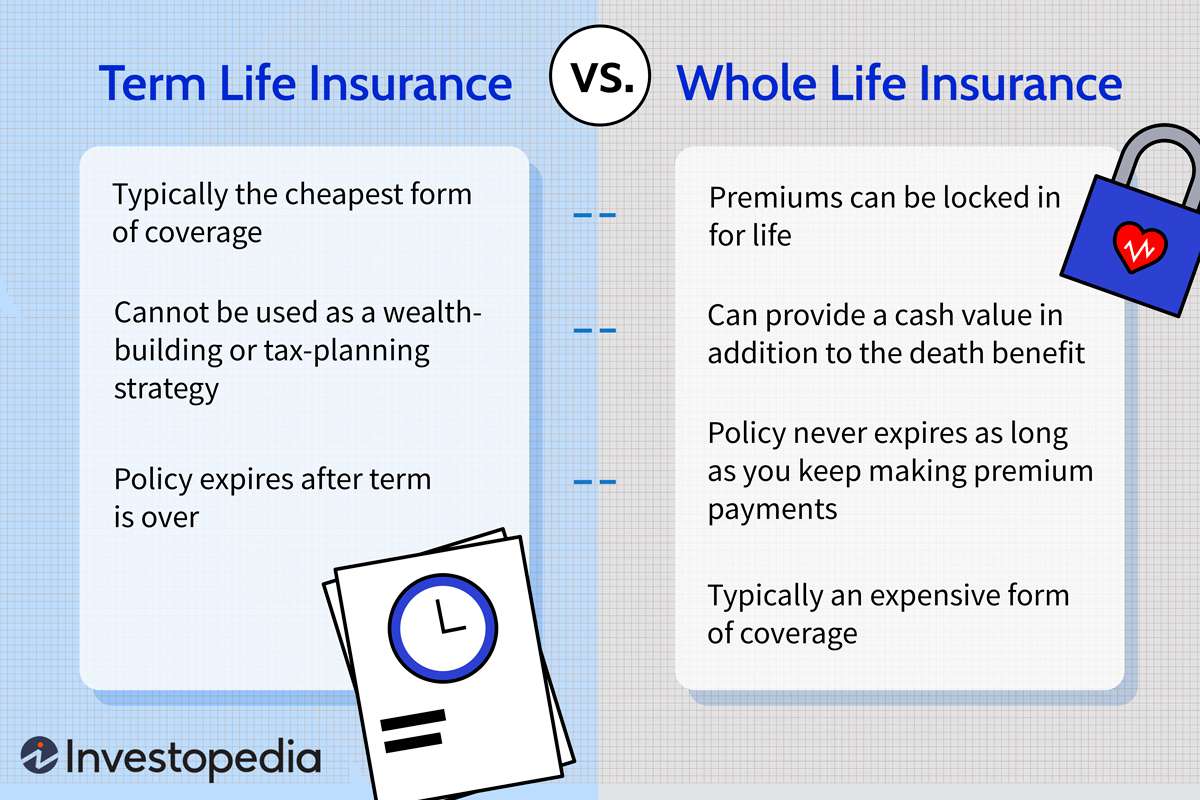

Comparing Term Life and Whole Life Insurance

When deciding between term life insurance and whole life insurance, it is essential to consider various factors that can impact your decision. Let’s compare these two types of life insurance across key parameters.

Cost Considerations

One of the most significant differences between term life insurance and whole life insurance is the cost. Term life insurance is generally more affordable than whole life insurance. The premiums for term life insurance are fixed for the term duration and tend to be lower, especially for young and healthy individuals.

On the other hand, whole life insurance premiums are typically higher due to the lifelong coverage and the cash value component. The premiums for whole life insurance remain fixed throughout the policy’s duration, which can provide stability and predictability for budgeting purposes.

It is important to assess your financial situation and future goals to determine which type of insurance aligns with your budget.

Coverage Duration

Another crucial factor to consider is the coverage duration. Term life insurance provides coverage for a specified term, such as 10, 20, or 30 years. If the insured individual passes away within the term, the death benefit is paid out to the beneficiaries. However, if the term expires and the insured individual is still alive, there is no payout.

Whole life insurance, as the name suggests, offers coverage for the entire life of the insured individual. The policy remains in force as long as the premiums are paid. This lifelong coverage ensures that the death benefit is paid out whenever the insured individual passes away, regardless of age.

When deciding between term life insurance and whole life insurance, consider your specific coverage needs and the duration for which you require financial protection.

Cash Value Accumulation Comparison

One of the distinguishing features of whole life insurance is the accumulation of cash value over time. With each premium payment, a portion goes into the cash value account, which grows at a guaranteed fixed rate set by the insurer. This cash value can be accessed through policy loans or withdrawals, providing flexibility and liquidity.

Term life insurance, on the other hand, does not accumulate cash value. The premiums paid for term life insurance solely go toward the cost of the death benefit. If the insured individual outlives the term, there is no return of premiums or cash value.

If cash value accumulation is an important consideration for you, whole life insurance offers the advantage of building up savings over time.

Flexibility and Convertibility

Flexibility is a critical aspect to consider when choosing a life insurance policy. Term life insurance offers flexibility in terms of coverage duration. You can choose the term that aligns with your specific needs, whether it’s to provide financial protection until your children are financially independent or to cover a particular liability, such as a mortgage.

Some term life insurance policies also offer the option to convert to a permanent life insurance policy, such as whole life insurance or universal life insurance, without undergoing a medical examination. This can be beneficial if your circumstances change, and you need lifelong coverage or access to the cash value component.

Whole life insurance, while less flexible than term life insurance, offers stability and predictability. The coverage remains in force until the insured individual passes away, ensuring lifelong protection. Additionally, the premiums remain fixed throughout the policy’s duration, providing peace of mind for budgeting purposes.

Suitability for Different Life Stages

The suitability of term life insurance and whole life insurance may vary depending on your life stage and financial goals. Here are some considerations for different life stages:

Young Professionals and Families: Term life insurance is often a popular choice for young professionals and families. It offers affordable coverage during the years when financial obligations, such as mortgage payments and raising children, are at their peak. The death benefit can provide financial security for your loved ones if you pass away unexpectedly.

Mid-Life and Retirement: Whole life insurance may be more suitable for individuals in mid-life or nearing retirement. As you age, the cost of term life insurance increases significantly. Whole life insurance offers lifelong coverage and can be considered as part of an overall estate planning strategy. The cash value can provide supplemental income or be used for legacy planning.

Business Owners: Both term life insurance and whole life insurance can play a role in protecting the financial interests of business owners. Term life insurance can be utilized to cover key persons within the business or as collateral for business loans. Whole life insurance can provide liquidity for business succession planning or buy-sell agreements.

It is important to assess your current life stage, financial goals, and specific needs to determine which type of life insurance is the best fit for you.

How to Choose Between Term and Whole Life Insurance

Choosing between term life insurance and whole life insurance requires careful consideration of various factors. Here are some key steps to guide you in making an informed decision:

Factors to Consider

- Coverage Needs: Assess your specific coverage needs, including the duration and amount of coverage required. Consider your financial obligations, such as mortgage payments, education expenses, and other liabilities that you would like to protect.

- Budget and Affordability: Evaluate your budget and determine how much you can comfortably allocate towards life insurance premiums. Consider both short-term affordability and the long-term impact on your financial goals.

- Financial Goals: Consider your long-term financial goals, such as retirement planning, estate planning, or creating a legacy. Whole life insurance with its cash value accumulation feature may align better with certain financial objectives.

- Risk Tolerance: Evaluate your risk tolerance and preferences. Term life insurance provides coverage for a specific term, while whole life insurance offers lifelong protection. Consider your comfort level with having coverage for a finite period or throughout your lifetime.

Determining Your Coverage Needs

To determine the appropriate coverage amount, consider your financial obligations and the financial impact of your absence on your family. Calculate your outstanding debts, such as mortgages, loans, or credit card debts. Evaluate your family’s ongoing expenses, such as living costs, education expenses, and healthcare needs.

Additionally, consider future financial goals, such as providing a financial safety net for your children’s education or leaving a legacy for future generations. Balancing these factors will help you arrive at an appropriate coverage amount that adequately protects your loved ones.

Affordability and Budgeting

Affordability is a crucial consideration when selecting a life insurance policy. Term life insurance typically offers more affordable premiums, especially for young and healthy individuals. However, it is important to consider the long-term cost implications, particularly if you require coverage beyond the term duration.

Whole life insurance premiums are generally higher due to the lifelong coverage and the cash value accumulation feature. Consider your budget and determine how much you can comfortably allocate towards life insurance premiums without compromising your other financial goals.

Seeking Professional Advice

Navigating the complexities of life insurance can be challenging, especially when deciding between term life insurance and whole life insurance. Seeking professional advice from a qualified insurance agent or financial advisor can provide valuable insights and help you make an informed decision.

An insurance agent or financial advisor can assess your specific needs, goals, and financial situation to recommend the most suitable type of life insurance. They can also guide you through the application process, explain policy provisions, and help you understand the long-term implications of your decision.

Alternatives to Term and Whole Life Insurance

While term life insurance and whole life insurance are the most common types of life insurance, there are other alternatives worth considering. These alternatives offer different features and benefits, providing additional options to meet your specific needs.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility and the potential for cash value accumulation. It combines a death benefit with a savings component, allowing policyholders to adjust their premiums and death benefit amounts over time. Universal life insurance policies typically provide more flexibility than whole life insurance in terms of premium payments and death benefit options.

Variable Life Insurance

Variable life insurance is another type of permanent life insurance that allows policyholders to allocate their premiums among various investment options. The cash value component of a variable life insurance policy is invested in sub-accounts, similar to mutual funds. The policy’s cash value and death benefit can fluctuate based on the performance of these investments.

Indexed Universal Life Insurance

Indexed universal life insurance is a form of permanent life insurance that provides a death benefit and the potential for cash value growth based on the performance of a specific financial index, such as the S&P 500. Policyholders can choose between various index accounts, offering the potential for higher returns compared to traditional universal life insurance.

It is important to discuss these alternatives with a qualified insurance agent or financial advisor to determine their suitability for your specific needs and financial goals.

Frequently Asked Questions

Q: What happens to term life insurance at the end of the term?

A: Most term life insurance policies are temporary, meaning that the coverage expires at the end of the term. If you still need life insurance, you can purchase a new policy. However, the premiums for a new policy may be higher, especially as you get older. Some policies may offer the option to convert to a permanent life insurance policy before the deadline set by the insurer.

Q: Why is term life insurance cheaper than whole life?

A: Term life insurance is generally more affordable than whole life insurance because it provides temporary coverage without the cash value accumulation feature. Whole life insurance premiums are higher due to the lifelong coverage and the cash value component.

Q: Does term life insurance build cash value?

A: No, term life insurance does not build cash value. The premiums paid for term life insurance solely go toward the cost of the death benefit. If you outlive the term, there is no return of premiums or cash value.

Q: Which is better, whole or term life insurance?

A: The choice between whole life insurance and term life insurance depends on your specific needs, goals, and financial situation. Term life insurance is often suitable for individuals who require coverage for a specific term and want more affordable premiums. Whole life insurance offers lifelong coverage and the opportunity to accumulate cash value, making it suitable for individuals with long-term financial goals or the need for lifelong protection.

Q: What are the main differences between term and whole life insurance?

A: The main differences between term life insurance and whole life insurance include the coverage duration, cost, and cash value accumulation. Term life insurance provides coverage for a specified term and has lower premiums. Whole life insurance offers lifelong coverage, higher premiums, and the opportunity to accumulate cash value.

In conclusion, the choice between term life insurance and whole life insurance depends on your individual needs, financial goals, and budget. Term life insurance offers affordable coverage for a specific term, while whole life insurance provides lifelong protection and the potential for cash value accumulation. Evaluating your specific circumstances and seeking professional advice can help you make an informed decision that provides the necessary financial protection for you and your loved ones.