Introduction

In the ever-evolving luxury industry, the year 2024 is set to witness a significant shift in the global market landscape. As luxury brands prepare to navigate a new array of challenges and opportunities, one country stands out as a key player in driving luxury fashion growth: China. With its robust economy, growing consumer base, and evolving preferences, China is poised to dominate the luxury market in the coming years. This article explores the predictions for the luxury market in 2024, focusing on the growth in China and its implications for luxury brands worldwide.

Market Growth Outlook

The luxury market is expected to experience a notable deceleration in growth in 2024. Market analysts, including Équité Research and Bain, forecast a stabilization of growth rates at historical levels of approximately 4-7 percent across all regions. This shift indicates a normalization in the industry after the unprecedented surge in demand following the pandemic.

Luxury brands are now strategizing for steady and sustainable growth, as they face the reality of reassessing brand investments by discerning consumers. Brands with a proven track record in building long-term brand equity are emerging as winners, while those that pursued easy growth paths and lacked excellence in execution may face losses. This recalibration in the luxury market signifies a shift towards a more balanced and thoughtful approach to consumption.

Elevated Luxury Brand Expectations

As luxury brands implemented significant price hikes during the pandemic, consumers have become increasingly discerning. With higher price points, clients now expect considerably more value from luxury brands. However, many brands are struggling to meet these heightened expectations.

Conversations with industry leaders and ultra-high-net-worth individuals reveal that client experiences often fall short of brand promises, affecting service delivery, product quality, and craftsmanship. Brands that have prioritized rapid growth by cutting corners are now facing the consequences, as clients rigorously scrutinize brands and demand value and authenticity in exchange for their loyalty and investment.

This trend is influenced by the rising influence of Gen Z in luxury purchases. Gen Z, known for their digital connectedness and higher expectations, seeks brands with clear personalities and distinctive brand stories that align with their own. Brands that fail to connect with these young consumers risk significant challenges, as Gen Z now constitutes a substantial portion of luxury purchases globally.

Challenges for Turnaround Brands

2024 is expected to be a challenging year for brands undergoing a reset or turnaround. Brands such as Gucci, Burberry, and Ferragamo, still in the process of strengthening their brand equities, may find it difficult to compete against others with more firmly established brand identities in the minds of consumers.

Many underperforming brands are also overexposed to multibrand retailers, further complicating their efforts to regain relevance. For example, Farfetch is grappling to stay relevant in a rapidly changing world of client expectations. Luxury brands in need of a turnaround must address issues related to brand storytelling, client relevance, sales channels, quality improvement, and brand experiences simultaneously.

To succeed in the luxury industry, brands cannot afford to play it safe. The lack of audacious, daring, and distinctive creative approaches is a common pitfall for many brands. In an industry where being perceived as boring can be detrimental, brands must embrace creativity as a means of standing out and captivating consumers.

Emphasizing Cultural Capital and Core Values

While some brands face challenges, industry leaders are excelling and expanding their lead. Brands like Louis Vuitton and Hermès are focusing on reinforcing their core values and cultivating cultural capital. Louis Vuitton’s appointment of Pharrell Williams has proven to be a catalyst in generating cultural relevance, while Hermès’ iconic Birkin bag continues to attract clients seeking trusted long-term investments.

The best-performing brands in 2024 will prioritize authenticity, brand heritage, and unique narratives. This strategic focus aligns with the changing consumer mindset, where consumers increasingly value brands that stay true to their essence while innovatively expressing their values. Brands that effectively articulate their brand storytelling and core values are poised to take the lead in the luxury market.

The Rise of Quiet Luxury

In 2024, a significant trend in the luxury market is the rise of quiet luxury. This shift represents a departure from the past patterns of fast and conspicuous consumption to a preference for refinement, craftsmanship, and core values. Consumers are moving away from impulsive purchases and embracing more thoughtful and selective consumption.

Quiet luxury emphasizes quality and substance over ostentation. Consumers now seek products that embody these qualities, reflecting a growing desire for long-lasting and meaningful possessions. Luxury brands that align with this trend have an opportunity to capture the attention of discerning consumers who value the authenticity and craftsmanship behind their products.

Redefining Luxury in 2024

The luxury industry in 2024 is poised for significant change. Luxury brands must inspire and create cultural relevance while delivering on craftsmanship and brand experiences that are both relevant and distinctive. Easy growth strategies will no longer suffice, as luxury clients now expect more from brands.

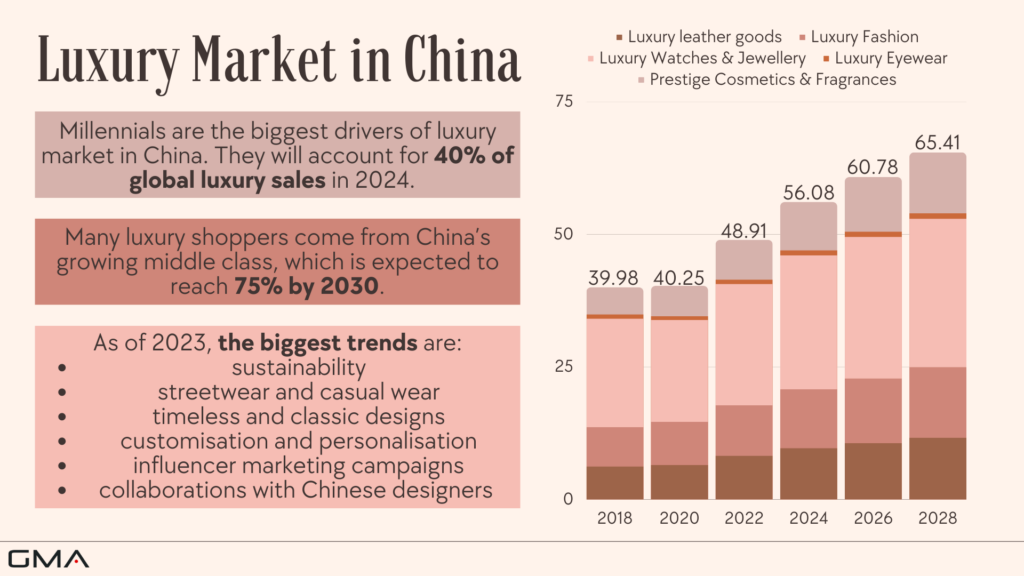

China, in particular, will play a crucial role in driving luxury fashion growth. With its strong economy, expanding consumer base, and evolving preferences, China presents immense opportunities for luxury brands. However, brands must adapt to the unique characteristics of the Chinese market, including cultural nuances and digital connectivity, to succeed in this rapidly growing luxury landscape.

In conclusion, the luxury market in 2024 will witness a shift towards sustainable growth, elevated brand expectations, challenges for turnaround brands, emphasis on cultural capital and core values, the rise of quiet luxury, and a redefinition of luxury itself. China’s leading role in luxury fashion growth highlights the importance of understanding and catering to the preferences of this influential consumer market. Luxury brands that can navigate these dynamics and adapt to changing consumer demands will thrive in the new era of luxury.